When it comes to cryptocurrencies like Bitcoin, there are definitely some inherent advantages to performing your online payments through virtual currencies over fiat currencies (like $ USD, € Euro, or £ Pound sterling / British Pound). As such, that not only goes for online shopping, but also for any time that you’re looking to play on an online casino. Take playamo for example, which is one of the best (if not the best) Online Casinos around that not only accepts its customers payments in fiat currencies (meaning standard currencies), but also accepts its customers’ online payments with Bitcoin.

Just as online exchanges with cryptocurrencies came up many years ago and evolved to a more common standard nowadays, so have Online Casinos that accept their customers’ payments in Bitcoin started to quickly come up, now dominating the web.

Now, if you do fancy a spin of the wheel, there are some important things that you need to about Bitcoin. First of all, there are several advantages when it comes to playing in an Online Casino by paying in Bitcoin (that is, if the website accepts it, of course). In the same fashion, there are also a few disadvantages of paying in Bitcoin that you definitely should be aware of.

Join us in this article / guide, where we cover in detail both the advantages and disadvantages of performing online payments in Bitcoin to play in Online Casinos that accept cryptocurrency payments.

THE MAIN ADVANTAGES OF BITCOIN

As we all know, a cryptocurrency is a digital asset that simply uses digital files as a money form. Each type of cryptocurrency is stored and transacted only through designated software, mobile or computer applications, or ultimately, through dedicated digital wallets.

Not only that, but all cryptocurrency-related transactions occur over the internet through secure and dedicated networks in which those same transactions are verified, and its records are maintained by a decentralized system using cryptography, rather than by a centralized authority.

Now, due to the unique nature of these unregulated digital currencies that are only available in electronic form, there are five main advantages of performing online payments in Bitcoin. Those are:

- User Anonymity on Online Payments

- Increasingly Wide Acceptance as a Payment Method

- International Transactions Easier Than Regular Currencies

- Generally Lower Transaction Fees (for International Payments)

- Finite Supply

Anonymity on Online Payments

As you most likely know (or at least should know), there are intense privacy protections integrated directly into Bitcoin’s source code that ultimately allow each Bitcoin owner to keep their online identity completely anonymous.

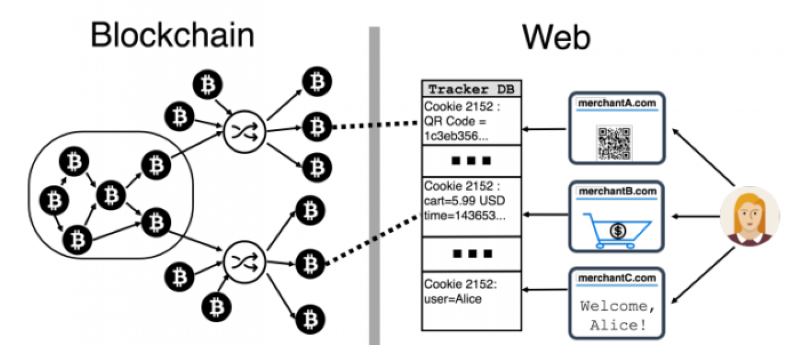

The overall system is designed to publicly record Bitcoin transactions and any other relevant data without ever revealing the identity of any individuals or groups involved in those transactions. As such, Bitcoin users are solely identified by public keys, sometimes by numerical codes that identify them to other users, and ultimately, by pseudonymous handles or usernames.

To put it in a more simple manner, the Bitcoin payment system is purely based on peer-to-peer networking communications, which basically means that users are able to send and receive payments to or from anyone around the world on that same network without ever requiring approval from any external source or authority.

All of these additional methods of protection ultimately allow users to further conceal the source and flow of Bitcoin. For example, “Mixing Services” are special computer programs available to all Bitcoin users that are designed to privately swap a specific Bitcoin unit for another Bitcoin unit of identical value, thereby obscuring the source of the owner’s holdings.

Increasingly Wide Acceptance as a Payment Method

When it comes to performing your online payments by using a cryptocurrency, Bitcoin has been turning out to be increasingly more accepted as a payment method around the whole online world.

This is basically because users are able to send and receive Bitcoins by simple using a Smartphone or a computer, which, in theory, means that Bitcoin is available to populations of users without them requiring to have access to traditional banking systems, as well as without needing a credit card or any other forms of payment (check out more info on this in Dailycoin’s article).

International Transactions Easier Than Regular Currencies

When it comes to paying in Bitcoin, it’s also important to note that it is much easier to perform any International Transactions by paying with Bitcoin rather than by paying with regular currencies (meaning fiat currencies).

That’s because while it is considered a standard thing among cryptocurrency exchanges to be charged with the so-called “maker and taker fees“, as well as with some occasional deposit and withdrawal fees, Bitcoin users are actually not subject to the litany of traditional banking fees that are commonly associated with any payments done with fiat currencies.

Ultimately, this means that you’ll have no account maintenance or minimum balance fees when paying with Bitcoin, and that also applies for not having any overdraft charges and no returned deposit fees, among many others advantages.

Generally Lower Transaction Fees (for International Payments)

Even more, specifically for International Payments, you get generally lower transaction fees for your online payments when paying with Bitcoin, rather than when paying with fiat currencies.

This is mainly because both Standard Wire Transfers and any Foreign Purchases made with fiat currencies typically involve somewhat “heavy” fees as well as exchange costs.

However, when it comes to Bitcoin transactions, those have no intermediary institutions or government involvement, so the transaction fee costs of trading Bitcoin between two entities are kept at a very low cost.

Because of that, this can ultimately be a major advantage for anyone that travels around the world regularly. Additionally, any payment transfer made in Bitcoins also happens very quickly, which completely eliminates the inconvenience of the typical authorization requirements and wait periods that are regularly associated with performing any online payments with fiat currencies.

Finite Supply

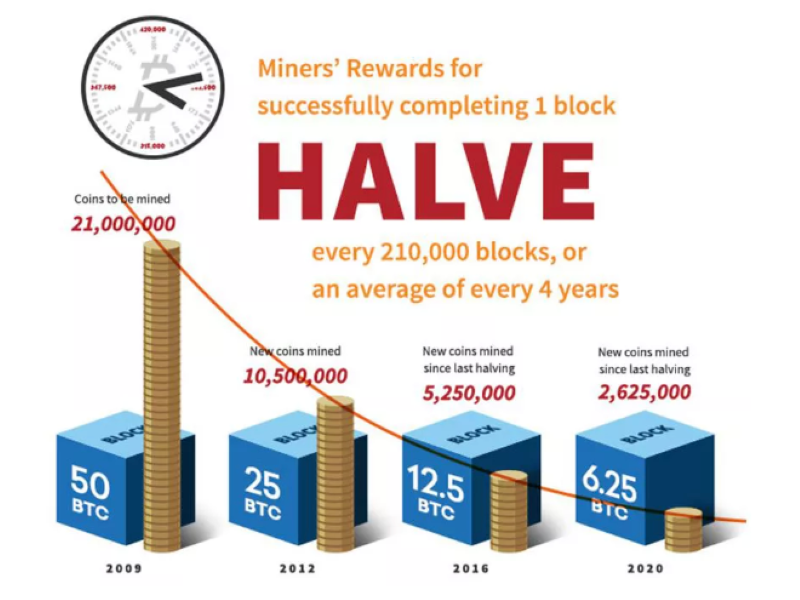

Lastly, it’s also important to note that while the Bitcoin system seems to keep on going forever, Bitcoin’s own source code actually places a strict limit on the maximum number of Bitcoin units that can ever exist; that’s no more and no less than 21 million Bitcoin units at a single time. As such, the existing number of Bitcoin units will never ever go over that amount.

This is achieved by simply slowing down the rate at which the creation of new block chain copies produces new Bitcoin. Over time, and around every four years or so, this rate halves. Because of that, the last Bitcoin to ever be created is projected to spring into sometime around 2140 – that is, if the currency still exists at that point in the future, as well as if people still care enough to mine it.

After the last Bitcoin unit of those 21 million maximum existing Bitcoins is created, every Bitcoin miners’ sole compensation will be no more than Bitcoin transaction fees (so, if you’re still young and you’re looking to mine Bitcoin, MINE IT NOW).

Ultimately, this enforced scarcity is one of the main key points that clearly makes Bitcoin a very distinct currency (and online payment method) from any traditional fiat currencies that central banks produce by decree, which, for the latter, supply is theoretically unlimited.

In that regard, Bitcoin has more in common with gold – which obviously is also limited and will have its supply end once we’ve extracted all of the remaining gold from Earth – than with the U.S. dollar.

THE MAIN DISADVANTAGES OF BITCOIN

Know, just like every other online payment, performing an online payment with cryptocurrency such as Bitcoin also has some important disadvantages that I’d like to note, but those can still be easily avoided if you know what to look out for. Those are:

- Exposure to Bitcoin-Specific Scams and Fraud

- Susceptibility to High Price Volatility

- Potential to Be Replaced by Superior Cryptocurrency

Exposure to Bitcoin-Specific Scams and Fraud

Since Bitcoin currently is the world’s most popular cryptocurrency, this specific cryptocurrency has obviously seen its fair share of medium-specific scams, fraud, and attacks.

Those can range from small-time Ponzi schemes (like Bitcoin Savings & Trust) all the way to massive hack attacks such as the breaches that felled Tokyo-based bitcoin exchange service Mt. Gox, which was a horrific $460 Million Disaster based solely in Bitcoin transfers.

Keep in mind that unlike Bitcoin, other cryptocurrencies still don’t have the critical mass of users that are necessary to make committing such immoral crimes this profitable to criminals. Because of that, criminal activity like Scams and/or Fraud schemes are more likely to be prosecuted by law enforcement agencies only when traditional currencies (meaning fiat currencies) and payment platforms based on standard currencies are involved.

So, when paying with Bitcoin, keep that in mind. Still, as long as you stay away from Scams and Frauds, you should be good and your Bitcoin value should be protected, mainly thanks to its cryptography-based system keeping all of your payments anonymous and your identity protected.

Susceptibility to High Price Volatility

While Bitcoin is in fact the most liquid and easily exchanged cryptocurrency that’s currently available, it still remains susceptible to wild price fluctuations during unexpected short periods of time.

In the light of the already-mentioned Mt. Gox bitcoin exchange service collapse, Bitcoin’s value fell by more than 50%. After that happened, during November 2013, the FBI sent a letter to the committee, making an official announcement that it would start recognizing Bitcoin and other virtual currencies as “legitimate financial services”, so naturally, right after that was announced, people felt safer again, and Bitcoin’s value spiked by a similar amount.

Then, just a few years later, during 2017, Bitcoin’s value doubled several times, only to halve again in the first weeks of 2018, which ultimately wiped-out billions of dollars in value within its “online market” almost overnight.

While Bitcoin’s volatility sometimes offers short-term benefits for speculative traders, it also makes this specific form of online and unregulated currency unsuitable for more conservative investors with longer time goals.

Lastly, since Bitcoin’s purchasing power varies so widely from week to week, it’s difficult for consumers to use it as a legitimate means of exchange. Obviously, some people won’t consider accepting a Bitcoin as payment when its valued at “just” $17,076 per Bitcoin, when they could potentially get up to $23,541 (values based on the time of writing this article, Dec 23, 2020). Contrarily to that, others that consider themselves to be mastermind investors won’t think twice when trading online, as they can potentially later resell that same Bitcoin for a higher profit.

Potential to Be Replaced by Superior Cryptocurrency

After Bitcoin successfully flooded the online market, it also became the main host of many successful cryptocurrencies. While many are structurally similar to Bitcoin, different cryptocurrencies have seen their systems offering notable improvements over Bitcoin’s system.

That’s because some newer cryptocurrencies make it even harder to track money flows or identify users, and that’s done mainly by using even more cryptography over each of their specific cryptocurrency transactions.

Not only that, but there are even other types of cryptocurrencies that use “smart contract” systems which hold service providers accountable for their promises. Furthermore, some even have in-house exchanges that let users exchange cryptocurrency units directly for fiat currency, which basically eliminates third-party exchanges and also helps to reduce any associated fraud risks.

As such, as time goes on, one or more of those cryptocurrency alternatives could end up usurping Bitcoin as the world’s dominant cryptocurrency, and that could obviously impact Bitcoin’s value in a negative manner, leaving its committed and long-term users holding a once-highly-valued cryptocurrency that could potentially end-up becoming worthless.

CONCLUSION

Now that you’ve reached the end of our detailed article about the main advantages and disadvantages of performing your online payments with Bitcoin, you should know exactly what to count on when using Bitcoin for any online payment.

Starting with your online identity being kept completely anonymous, and also considering that Bitcoin is becoming increasingly accepted worldwide as a payment method where its International Transactions are way easier to perform than when paying with fiat currencies (which also have higher fees when compared to Bitcoin payments), you should at least have some more confidence and feel a bit more safer performing any online payments with Bitcoin.

Just remember to keep your eyes open for any potential Bitcoin-Specific Scams or Fraud-Schemes, as well as wait for any price fluctuations that negatively affect it. So, with that said, always wait for a time where Bitcoin is valued at a reasonably high-price (when converted to fiat currencies) before trading or performing any online payments with it.