While the virtual world becomes an integral part of our lives, it has its drawbacks, and you need to be highly cautious when inserting your data into any online form. That is especially true when it comes to online paying systems – if a wrong person gets access to your personal data, you can lose all of your money. For this reason, you need to choose the paying services very carefully – and we are going to help you.

In this article, you will find a list of the pros and cons of several online paying systems, such as PayPal, Klarna, Skrill, Google Pay, Amazon Pay, and some additional information about them. Read on and make sure to choose the right option next time you need to pay for something online.

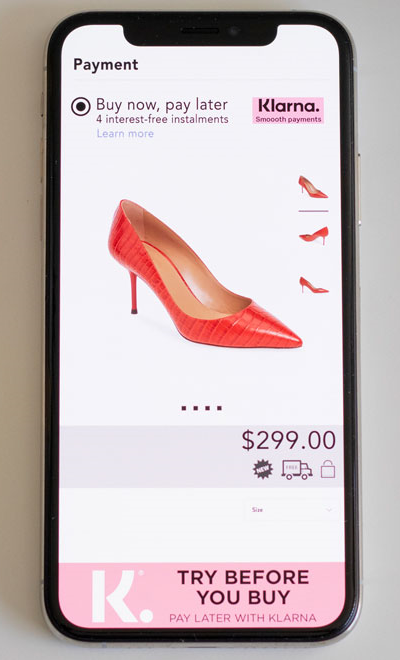

Klarna

Klarna is one of the most popular online paying services in Europe, especially in Sweden and Norway. It goes hand in hand with PayFit – a Paris-based payment processor.

Pros of using Klarna:

- Klarna has a wide range of payment options, so if PayPal doesn’t work for you, you might consider Klarna instead. For example, if you play in online casinos, opting for Klarna casino may be the most convenient payment option for you.

- Klarna has a good reputation and is regarded as one of the most secure online paying systems globally. The company has been working for many years, and its clients are extremely satisfied with its service. It is also easy to use and really convenient when shopping online.

- Klarna allows customers to pay for things in installments, which means that they do not have to pay for them all at once (with interest). It is an excellent option for people with lower income or those who just do not have enough money to pay for everything at once. In addition, the installments are flexible – they can be longer or shorter depending on what the customer needs.

Cons of using Klarna:

- If your credit score is low, Klarna might not accept your application for a payment method. This often happens when applying for a credit card or when you need a loan from the bank. In this case, you should go for another option.

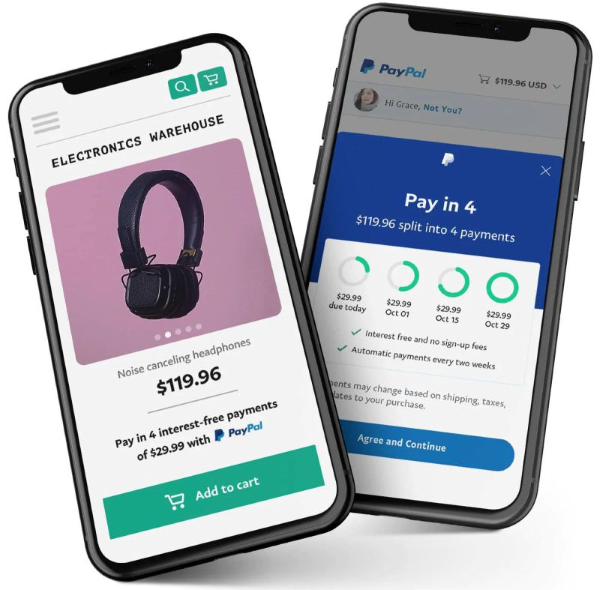

PayPal

PayPal is probably the most popular online paying service in the world. Besides that, it is the best option for paying on US websites, since it is very well-known and widely used by all kinds of stores and businesses.

Pros of using PayPal:

- It is very safe to use. PayPal does everything possible to make sure that your personal data is not stolen or used by anyone.

- Online stores widely use it, so you can use it on any website you want without worrying about security issues.

- PayPal is fairly simple to use. You only need to enter your login and password (or you can connect with your Facebook account).

- You can use it with PayPal Credit – an alternative to credit cards to buy the things you need online.

Cons of using PayPal:

- If you do not have a bank account or do not want to pay with your card, you are out of luck. PayPal will not work for you.

- The fees are relatively high compared to the other available options. If you plan to purchase something worth less than $25, you will pay at least 2.9% + $0.30 fee per transaction, so it is better to choose another provider if possible.

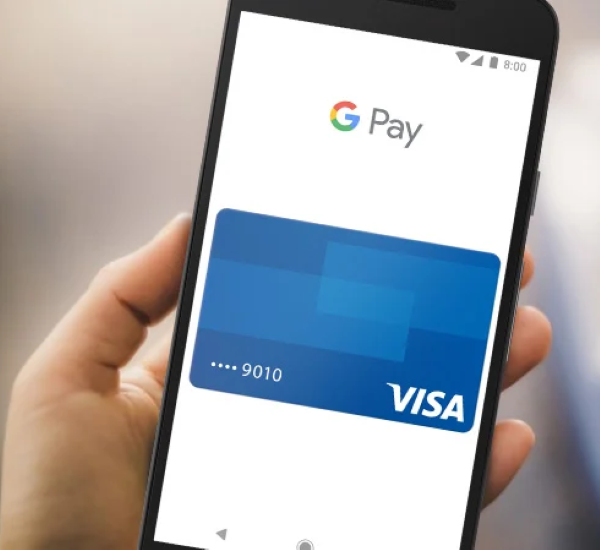

Google Pay

Google Pay is one of the newest online payment systems on the market – it was initially released in 2015 as Android Pay and became Google Pay in 2018. It has a simple interface, and it is effortless to use.

Pros of using Google Pay:

- It is very simple and easy to use. With Google Pay, you can easily shop online by adding your credit or debit card to your Google Wallet account, so you will not have to enter all the information manually too often.

- If you have a Google account, you can add your credit or debit card to Google Pay in just a few seconds. If you do not have a Google account, it is easy to set one up – all it takes is a few minutes of your time.

- It is very safe to use Google Pay because your information is encrypted and protected by the strongest security algorithms.

- The fees are low – there is almost no fee to use debit cards, make bank transfers, or for purchases made on US websites. However, the fee for credit cards is 2.9%.

Cons of using Google Pay:

- This system works only on Android devices. Those who do not have an Android device will have to choose another provider.

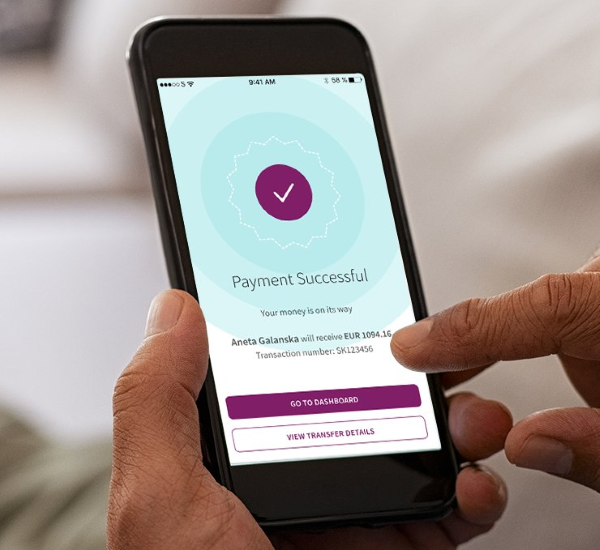

Skrill

Skrill is a digital wallet provider that lets users pay for things online with a wide range of money transfers and online payment services. It is used by millions of people in 120 countries and offers more than 40 currencies.

Pros of using Skrill:

- Like PayPal, Skrill also has good security measures in place – it does everything possible so that your information is safe and cannot be accessed by hackers or other malicious activities. In addition, the company’s employees are trained to deal with any security issues that might arise and make your life easy.

- Skrill is easy to use, so if you have used PayPal before, you will not have any difficulties using Skrill as well. All you need to do is log in and enter your username and password. However, if you would rather connect with your Facebook account, this option is also available.

- It allows users to pay for things in installments, which means that you can pay for them over a longer period without paying interest (which can be convenient if you need some extra time to finalize the purchase). The thing about Skrill is that the installment period is flexible – it depends on what you need and how much money you have available in your account.

- You will only pay a 2.99% + $0.30 fee per transaction, which means that the fees are relatively low compared to many other options available today.

Cons of using Skrill:

- Skrill takes an increased commission for a double conversion of money.

- Not all international banks accept Skrill.

- Skrill customer support does not always respond quickly, so you should keep in mind that solving your inquiry can take a few days or more.

Amazon Pay

Amazon Pay has been around since 2007 and has become incredibly popular among all kinds of customers. It replaces older services offered by the company, such as Checkout and Simple Pay by Amazon.

Pros of using Amazon Pay:

- Amazon Pay is incredibly easy to use. It is as simple as adding a credit or debit card to your account, and then you will be able to make purchases online very quickly.

- It has a wide range of payment options, so if PayPal does not work for you, there is no need to worry – you can always consider Amazon Pay.

- The fees are fairly low compared to the other options on this list. The fee depends on your purchase price – if it is less than $10, there won’t be any fee. If it is between $10 and $100, you will pay $0.99 (+2.9% fee). If your purchase is over $100, you will pay $1.99 (+2.9% fee). This means that the more you spend on your order, the more you save on fees.

Cons of using Amazon Pay:

- Amazon Pay has no support for PayPal payments.

- A high probability of getting shut down if Amazon Pay thinks you are not following the rules.

- You will need to have an Amazon account to make a payment.

In Conclusion

As you can see, different payment services have their own advantages and disadvantages, so you should consider your needs and the primary purpose of your digital wallet when choosing a payment method that will work best for you. For example, one option will be suitable for making online purchases, while the other will allow you to make bank transfers with the lowest fee possible.

However, you should consider not only the costs but also the safety levels that an online paying service provides you with.