Investment, Not Expense: AI-driven eComm platform Sonalore shuns exorbitant retail markups, buys back its gold jewelry at current market value with lifetime guarantee

In today’s hugely saturated and competitive jewelry marketplace, distinguishing jewelry retailers can be a challenge for consumers. From lack of brand differentiation, compromised product transparency, value price wars, overlapping product offerings and inconsistent quality assurance to overwhelming digital noise and lack of personal brand connections, many companies in the space struggle to stand out.

One company taking the uber-competitive jewelry retail industry by storm is Sonalore, which has carved out a distinctive identity through a combination of brand discriminators. These include extreme pricing value without the industry standard artificially inflated markups; transparency in their product offerings; exclusive designs crafted by global artisans; ethically and responsibly sourced precious stones and fair wages for its workers; virtual try ons; compelling brand storytelling; and a superior customer experience.

One company taking the uber-competitive jewelry retail industry by storm is Sonalore, which has carved out a distinctive identity through a combination of brand discriminators. These include extreme pricing value without the industry standard artificially inflated markups; transparency in their product offerings; exclusive designs crafted by global artisans; ethically and responsibly sourced precious stones and fair wages for its workers; virtual try ons; compelling brand storytelling; and a superior customer experience.

While this mix of USPs is a powerful elixir resonating in the marketplace, perhaps the most noteworthy aspect of Sonalore’s approach is that it sells its 18-karat gold jewelry from the perspective of it being a sound investment—not an expense—that enduringly holds its value. This amid the company’s robust “lifetime buyback guarantee” program based on the fair current price valuation of gold that, incidentally, has the potential to increase beyond the purchase price of the item. Gold is, in fact, is a heralded investment commodity amid its historically proven performance in various economic environments. Among other drivers, gold investments are known for global demand and liquidity, serving as a tangible asset with no counterparty risk and offering a safe haven during economic turmoil.

Below is a conversation with Sonalore Co-Founders Nidhi Singhvi, who serves as CEO, and Navya Reddy detailing why the brand’s approach best serves today’s mindful and intentional breed of consumers and investors as well as the modern jewelry retail marketplace at large.

Below is a conversation with Sonalore Co-Founders Nidhi Singhvi, who serves as CEO, and Navya Reddy detailing why the brand’s approach best serves today’s mindful and intentional breed of consumers and investors as well as the modern jewelry retail marketplace at large.

MK: First, how would you describe and explain the Sonalore brand to those unfamiliar?

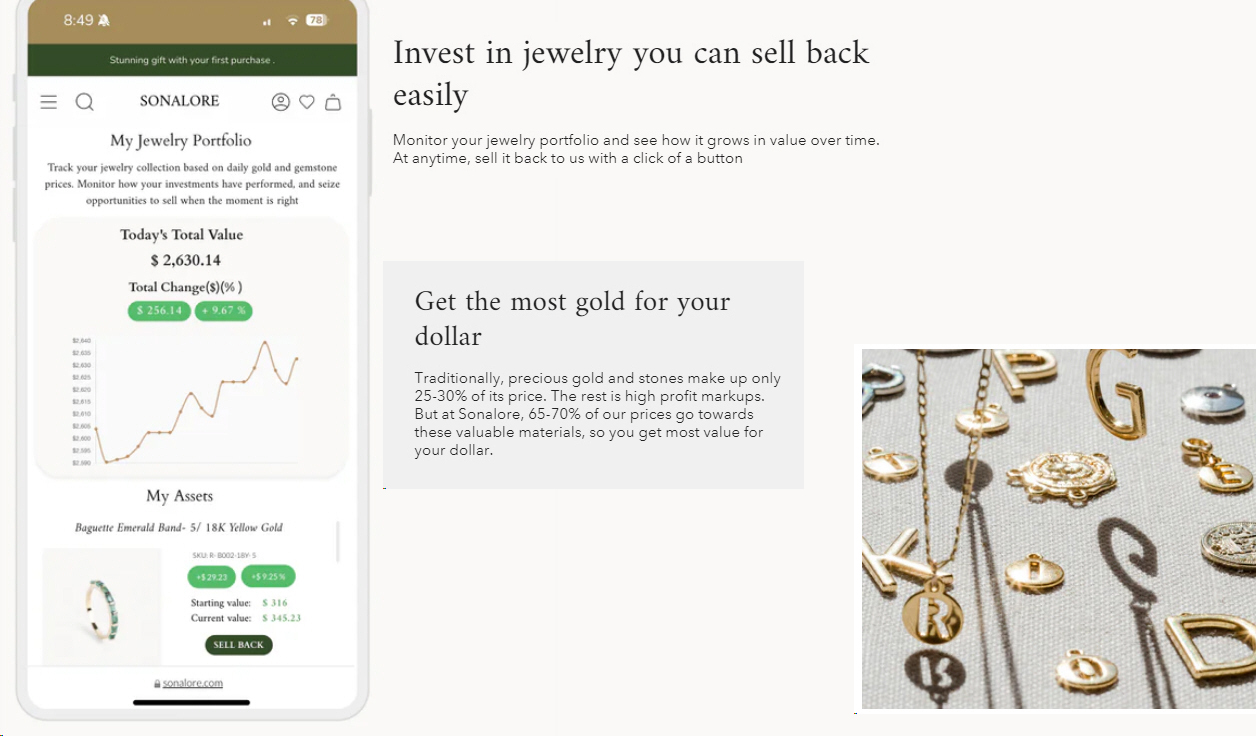

NS: Sonalore is an AI-powered unified platform for buying and selling fine jewelry, providing upfront, transparent material and crafting cost breakdowns with one click transactability. This is similar to how Carvana revolutionized car sales by offering clear pricing, or how Zillow brought transparency with “Zestimate”. Buyers can also confidently purchase jewelry at transparent prices with assurance of a lifetime buyback guarantee. Beyond providing gorgeous jewelry at affordable prices without ridiculous markups the industry is plagued by, we position gold jewelry as the investment that it is. Customers can sell their items back to the company as easily as they bought it, getting instant and fair buyback valuations higher than comps based on the current market price of gold. Our seamless logistics are also appealing since it helps customers easily refresh their collections anytime.

NR: Your company is built on a model of affordability. What is this founded on?

A: Yes, the $60 billion unbranded jewelry market is founded on insane markups, often 3 to five times, and are disconnected from the metal content. In fact, most jewelry companies are operating on 65%+ gross margins, so they are not selling gold to you but rather are selling undifferentiated products with absurdly inflated pricing. Our customers also lament that they have jewelry lying around that they don’t wear anymore and still have to spend yet more to get new jewelry to enhance and modernize their collections in line with changing personal preferences and trends. We also foster loyalty and trust with our customers by provisioning our pieces with a Certificate of Authenticity akin to other investments. In all, we endeavor to change the fine jewelry market with a unique value proposition of great pricing combined with will utmost product detail transparency—one removing information asymmetry in the jewelry market to foster deep consumer loyalty. This we combine with social responsibility and conscious consumerism via ethically-sourced and made items as well as sustainability via free upgrades and the flexibility to sell back our wares at any time.

MK: What are the main challenges and pain points consumers face when trying to sell their jewelry?

NS: The jewelry re-sell market is value is $30-40 billion, so consumers clearly have this need and desire. But, re-monetizing their jewelry can be a headache via person-to-person attempts or at pawn shops—this noting that our own survey showed fully 90% of people have considered selling their jewelry, but would not feel comfortable walking into a store to do so. Other resale pain points include opaque pricing, where customers receive only 20-60% of the value, and a laborious process involving 2-4 evaluations with a 1-4 week lead time for estimates. Additionally, there is uncertainty around the sale, as many venues are unwilling to hold inventory. The overall anti-luxury experience actively discourages casual sellers from engaging in the process. Our AI powered “SonaQuote” buyback tool is quick and transparent. It gives consumers the ability to track the value of their virtual “jewelry box” over both time and market movements as well as a one-click sell process whenever the consumer wants.

NS: The jewelry re-sell market is value is $30-40 billion, so consumers clearly have this need and desire. But, re-monetizing their jewelry can be a headache via person-to-person attempts or at pawn shops—this noting that our own survey showed fully 90% of people have considered selling their jewelry, but would not feel comfortable walking into a store to do so. Other resale pain points include opaque pricing, where customers receive only 20-60% of the value, and a laborious process involving 2-4 evaluations with a 1-4 week lead time for estimates. Additionally, there is uncertainty around the sale, as many venues are unwilling to hold inventory. The overall anti-luxury experience actively discourages casual sellers from engaging in the process. Our AI powered “SonaQuote” buyback tool is quick and transparent. It gives consumers the ability to track the value of their virtual “jewelry box” over both time and market movements as well as a one-click sell process whenever the consumer wants.

MK: How have consumer perceptions of gold as an asset evolved in recent years, and how does your product model appeal changing attitudes?

NR: People are increasingly knowledgeable about gold, especially across the U.S., and positioning our products to be “worn then reborn” with a “buy-enjoy-sell back-repeat model” is resonating with customers. Jewelry is largely seen as an investment in rest of the world like, in Asia, jewelry is regarded as an asset and bought and sold like one and maintains over 70% resale value as compared to less than 30% in the U.S. Generally, those closely following price action and are aware that gold is currently around $2,700 per ounce. The number one sentiment we hear is, ‘gold has been crazy this year, and with all the world’s uncertainty, it’s only going up.’ Many customers also mention how gold prices have significantly increased. While just a few years ago gold was more affordable, now the rising prices make it feel like a more serious investment. Family dynamics also play a big role in gold’s appeal, with many regarding it as a cherished heirloom gift from parents with intrinsic fiscal value.

MK: Can you describe your background and how it relates to having established yourself in the jewelry industry?

NS: Navya and I grew up in Asia where jewelry is considered investment. It has been a source of immense self-respect and power for women in a society where women didn’t have ownership of other assets and didn’t have an income. Jewelry was something that was a woman’s own treasure chest and, when need be, her own war chest. There are numerous stories in India where women moved their entire families forward using jewelry to fund dreams. Navya have similar stories too—when there was a need to further our experiences, our moms went against other family member wishes and “made things happen” realizing the true worth of their jewelry caches. Navya and I want to bring the same power to jewelry in America. Women in the U.S. are spending billions on jewelry, but are not accumulating any intentional wealth with it. We want to turn our customers into gold investors, and help hem pass on this wealth to whomever they want. Sonalore helps women in America do just that and, in doing so, we are truly revolutionizing the jewelry experience. Our products are both a pleasure to wear and smart to own.

MK: OK, let’s talk specifically about the gold commodity landscape specifically a bit. Why is gold a smart investment today, even with inflation and cooling prices?

NR: In short, macro uncertainty. The ongoing geopolitical tensions, including two major wars and trade uncertainties, make gold an attractive safe-haven asset, providing stability in investment portfolios during economic challenges. Its historical performance, such as during the 2008 financial crisis, underscores its resilience as a store of value. At Sonalore, 60% of our customers have expressed interest in gold as an investment, reflecting its strong appeal in today’s macroeconomic climate. Additionally, major central banks are diversifying away from the US dollar, adding near-record amounts of gold to their reserves in 2023—a trend that signals long-term structural support for gold prices. Gold also offers significant portfolio diversification benefits, particularly for millennials, who now outpace baby boomers and Gen X-ers as the largest group of gold investors. With consistently low or negative correlation to other asset classes, gold remains an ideal tool for reducing portfolio risk.

MK: What economic indicators suggest physical gold will remain a strategic investment in 2025?

NS: Potential rate cuts in 2025 are expected to lower real yields, enhancing gold’s attractiveness as an investment since it doesn’t bear interest. Additionally, the anticipated “pivot” in monetary policy could further drive institutional investors toward gold, viewing it as a reliable hedge against potential currency devaluation.

MK: What do you recommend as the allocation strategy for physical gold?

NR: The optimal strategy depends on the investor’s goals. For new investors, it’s recommended to focus primarily on coins, allocating roughly 80% of their investment to them. Coins are easier to sell in smaller quantities, providing greater flexibility for partial liquidation, which is ideal for testing the market. For larger investments, a balanced approach with a mix of bars and coins—typically a 60/40 split—is more suitable. Bars serve as long-term core holdings, while coins offer the flexibility needed for quick liquidity.

MK: What would you say are common misconceptions about physical gold investments?

NS: One common misconception about investing in gold is that it is hard to sell. While selling gold may not be as instant as selling stocks, both online and offline platforms offer reliable liquidity options. At Sonalore, we provide unique liquidity for gold jewelry at prevailing gold prices, making it easier for investors to access their investment. Another misconception is that you need a lot of money to start investing in gold. In reality, gold investment can begin with small denominations, such as coins. Additionally, Sonalore allows customers to invest in gold while buying jewelry, such as purchasing 18k gold hoops and watching their value fluctuate with the market.

MK: How would you say investors should think about liquidity in physical gold?

NR: The gold market is highly liquid, fueled by strong institutional and retail demand, with multiple sales channels available both online and offline. Coins offer the quickest liquidity, making them easier to sell to government mints or private buyers. Proper documentation is essential to ensure smooth transactions, and investors should stay informed about market fluctuations to make well-timed decisions. By staying aware of the market, investors can make informed choices that maximize the value of their gold investments.

By positioning gold jewelry as a valuable asset that can be worn and sold back, Sonalore aligns with the growing interest in gold as a hedge against economic uncertainty and as a means of wealth accumulation. Also with a deep understanding of consumer pain points, such as opaque pricing and laborious resale processes, the company’s innovative model streamlines the jewelry investment experience, fostering customer trust and loyalty.

In all, Sonalore is redefining the jewelry industry by offering a transparent, customer-centric approach that focuses on both affordability and investment potential. The company’s commitment to eliminating inflated markups, providing clear pricing, and offering a lifetime buyback guarantee has resonated deeply with consumers seeking not only beautiful jewelry, but also a smart investment. Hat’s off to this innovative startup transforming how consumers view and invest in jewelry, making it both a personal and financial asset for the modern world.

~~~

Merilee Kern, MBA is an internationally-regarded brand strategist and analyst who reports on cultural shifts and trends as well as noteworthy industry change makers, movers, shakers and innovators across all categories, both B2C and B2B. This includes field experts and thought leaders, brands, products, services, destinations and events. As a prolific lifestyle, travel, dining and leisure industry voice of authority and tastemaker, Merilee keeps her finger on the pulse of the marketplace in search of new and innovative must-haves and exemplary experiences at all price points, from the affordable to the extreme. Her work reaches multi-millions worldwide via broadcast TV (her own shows and copious others on which she appears) as well as a myriad of print and online publications. Connect with her at www.TheLuxeList.com and www.SavvyLiving.tv / Instagram www.Instagram.com/MerileeKern / Twitter www.Twitter.com/MerileeKern / Facebook www.Facebook.com/MerileeKernOfficial / LinkedIN www.LinkedIn.com/in/MerileeKern.

Merilee Kern, MBA is an internationally-regarded brand strategist and analyst who reports on cultural shifts and trends as well as noteworthy industry change makers, movers, shakers and innovators across all categories, both B2C and B2B. This includes field experts and thought leaders, brands, products, services, destinations and events. As a prolific lifestyle, travel, dining and leisure industry voice of authority and tastemaker, Merilee keeps her finger on the pulse of the marketplace in search of new and innovative must-haves and exemplary experiences at all price points, from the affordable to the extreme. Her work reaches multi-millions worldwide via broadcast TV (her own shows and copious others on which she appears) as well as a myriad of print and online publications. Connect with her at www.TheLuxeList.com and www.SavvyLiving.tv / Instagram www.Instagram.com/MerileeKern / Twitter www.Twitter.com/MerileeKern / Facebook www.Facebook.com/MerileeKernOfficial / LinkedIN www.LinkedIn.com/in/MerileeKern.